Charging station market is highly fragmented in Europe with intense competition for market share and direct access to customers. Central Europe countries, in particular, have built impressive charging infrastructures; 70% of all charging stations in Europe are concentrated in just three countries: the Netherlands (66,665), France (45,751) and Germany (44,538). Together, these countries make up only 23% of the total EU area, therefore, the remaining 30% of charging infrastructure is scattered across the remaining 77% of Europe 1. Based on the calculations of the European Commission, a further 50% reduction in CO2 emissions from cars in 2030 would require approximately 6 million publicly available charging points; with less than 225,000 charging stations available in Europe today, this translates into a necessary 27-fold increase in less than a decade.

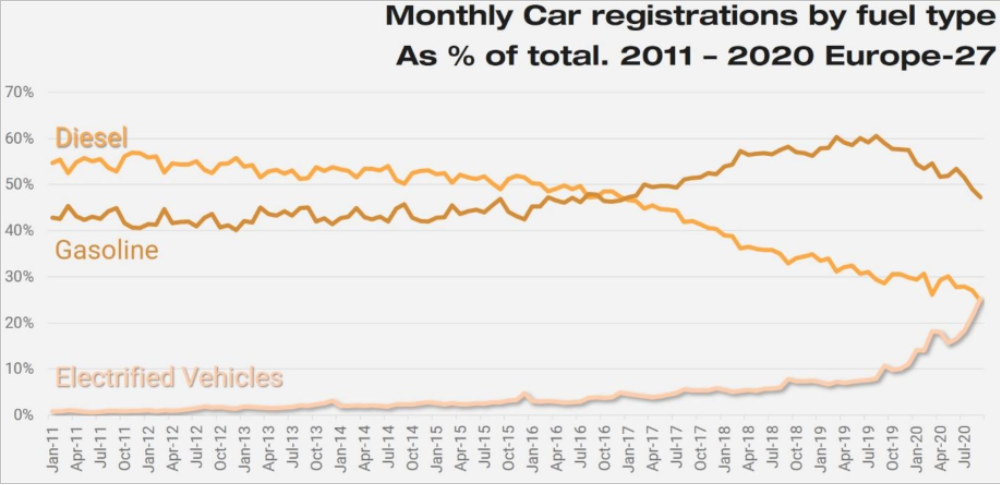

As for car sales in Europe, in 2020 there was a sharp decline in sales of internal combustion cars and a sharp increase in sales of electric cars. In particular, after reaching 7.5 million cars registered in 2019, the demand for petrol cars fell to 4.7 million units in 2020 (just 539,709 more units than in 2014); the number of diesel cars sold fell by nearly 2.6 million units over the same period. Electric vehicles increased by nearly 1 million units (to 1,045,082) over the seven-year period and it doubled, between 2019 and 2020, demonstrating that the transition to electric mobility is now underway 2.

Charging stations can be separated into two categories: normal and fast charge points. Normal ones charge below 22 kW (kilowatts) and fast ones above 22 kW. Fast chargers decrease the charging time significantly and the availability of such chargers plays a key role for the EV Charging infrastructure in Europe. However, of the 224,237 charging stations available across the EU today, only 24,987 are suitable for fast charging, while normal charging stations represent the vast majority (199,250); therefore, today only 1 in 9 charging points in the EU is a fast charger 3.

From a technological point of view, today practically all the new charging stations installed in public and semi-public contexts are equipped with IoT connectivity; in some European countries this is even mandatory. The operators remotely manage the charging stations or entrust the management to suppliers of white label solutions. Customers can locate chargers, initiate a charging process, track progress, and pay via online platforms. Networked charging stations are key to enabling widespread charging and accelerating the mass adoption of electric vehicles. In conclusion, Europe will continue to experience huge growth in the electric vehicle sector in 2021-2024, with double-digit percentage increases in most countries. Markets will see significant sales growth thanks to purchase subsidies, emissions directives, improved battery technology and the increased overall appeal of electric vehicles.

References

1E. A. M. Association, «Risk of two-track Europe for e-mobility with sharp divisions in roll-out of chargers, auto industry warns,» 29 06 2021. [Online]. Available:

https://www.acea.auto/press-release/risk-of-two-track-europe-for-e-mobility-with-sharp-divisions-in-roll-out-of-chargers-auto-industry-warns/.

2JATO, «In September 2020, for the first time in European history, registrations for electrified vehicles overtook diesel,» 29 10 2020. [Online]. Available:

https://www.jato.com/in-september-2020-for-the-first-time-in-european-history-registrations-for-electrified-vehicles-overtook-diesel/.

3European Alternative Fuels Observatory, «NORMAL AND HIGH-POWER PUBLIC RECHARGING POINTS (2020),» [Online]. Available:

https://www.eafo.eu/electric-vehicle-charging-infrastructure.